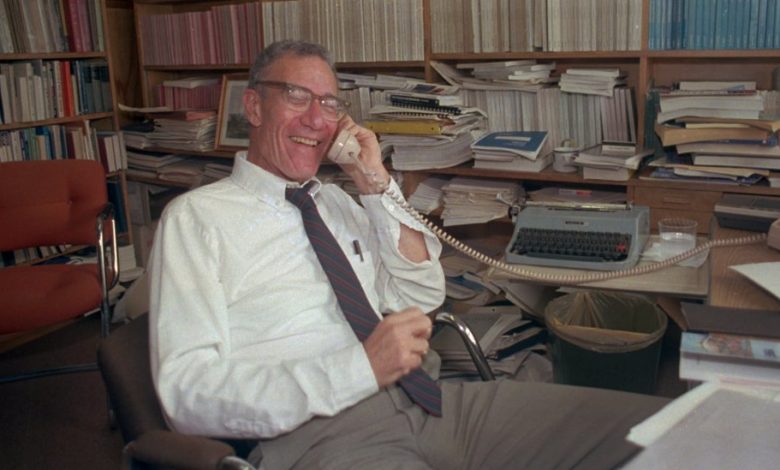

Robert M. Solow, Groundbreaking Economist and Nobelist, Dies at 99

Robert M. Solow, who won a Nobel in economic science in 1987 for his theory that advances in technology, rather than increases in capital and labor, have been the primary drivers of economic growth in the United States, died on Thursday at his home in Lexington, Mass. He was 99.

His son John confirmed the death.

Professor Solow (pronounced solo) taught at the Massachusetts Institute of Technology, where he and a fellow Nobel laureate, Paul A. Samuelson, forged the M.I.T. style of economic analysis, which emerged as a leading approach in the second half of the 20th century and played an important role in economic policymaking.

His work demonstrated the power of bringing mathematics to bear on important economic debates and simplifying the analysis by focusing on a small number of variables at a time.

Beyond the impact of his own research, Professor Solow helped launch the careers of a stunning number of future superstar economists, including four Nobel laureates: Peter Diamond, Joseph E. Stiglitz, William D. Nordhaus and George A. Akerlof. “My pride and joy,” Professor Solow said.

The affection was reciprocated. In an interview for this obituary in 2013, Alan S. Blinder, a Princeton University economics professor, former deputy chairman of the Federal Reserve Board and a Solow pupil, said, “All his former students idolize him — all, with no exceptions.”

Professor Solow received the John Bates Clark Medal in 1961 as the finest American economist under 40 and the National Medal of Science in 1999, a rare economist to receive that honor. In 2014, President Barack Obama awarded him the Presidential Medal of Freedom, the nation’s highest civilian honor.

Professor Solow’s research on economic growth became the model by which economists, well beyond the confines of M.I.T., came to practice their craft. For a century or more they simply “knew” that growth of capital and labor determined economic growth. But Professor Solow could not find data to confirm that common-sense presumption.

Besides, academic theories of economic growth that predated his writings had the discomforting implication that capitalist economies were always teetering between boom and bust. He observed that “the history of capitalism didn’t look like that.”

So what did explain growth? Entrepreneurs? Geography? Legal institutions? Something else?

“I discovered to my great surprise that the main source of growth was not capital investment but technological change,” Professor Solow said in an interview in 2009, also for this obituary. Specifically, he estimated that technical progress accounted for a surprising 80 percent of 20th-century American growth. He later pointed to Silicon Valley as a validation of his theory.

Technology Was Key

Professor Solow’s strategy — his gimmick, he liked to say — was to pick out one thing of special interest and simplify the role of everything else. The goal was to understand completely the role of a “little piece of the puzzle.” This strategy of inquiry came to be known as building “toy models.”

In analyzing economic growth, he singled out technological progress (the ability of society to translate inputs of capital and labor into outputs of goods and services) as independent from the other key variables, including population growth and returns on capital.

He devised a graph with two curves. One captured his simplifying assumption that population growth and technological knowledge rise at a constant rate over time. The second curve captured his all-important assumption that the economic impact of adding more and more capital gets weaker and weaker. Adding capital to an economy drives up total output, but each additional dollop of capital drives up output by less than the previous dollop did.

Put the two curves on the same graph and a powerful theory of growth emerged. Professor Solow showed that higher savings and investment would indeed make individuals richer on average — the level of income per person would rise. But the added savings and investment would not affect the economy’s long-term rate of growth. The impact of additional savings on permanent growth rates peters out in a way that, under Professor Solow’s assumption, the impacts of population and technical knowledge do not.

Out went 100 years of often fruitless, meandering debate. Professor Solow’s simple graph refocused the argument, providing a clear path to cause-and-effect statements about past and future growth. He published his growth model in 1956. At that point, he had provided an elegant theory. A year later, he presented evidence.

The Solow growth model, propounded in his book “A Contribution to the Theory of Economic Growth,” in 1956, and its empirical follow-up, “Technical Change and the Aggregate Production Function,” in 1957, made his reputation while he was in his early 30s and led in due course to the Clark Medal and the Nobel Memorial Prize in Economic Sciences.

“It really still is the basic story that the profession uses when it wants to talk about the determinants of growth,” Professor Solow said in the 2009 interview, conducted at the Russell Sage Foundation in Manhattan, where he spent several months each year after retiring from M.I.T. in 1995.

He reinforced his view of how economists should practice their craft by reconfiguring the all-important Ph.D. thesis. He pioneered the submission by Ph.D. candidates of three essays, each focusing analytical attention on a discrete economic problem, instead of a single volume stretched out over hundreds of pages.

The three-essay thesis soon proved the rule at M.I.T. and other graduate departments. In another interview for this obituary, in 2013, Professor Solow made the point that he wanted his Ph.D. advisees to do in their theses what they would be doing as modern economists: “writing articles, not tomes.”

A gifted writer, he was famous for his quick wit and puckish sense of humor. Once, at a conference in Chicago, he sparred with Milton Friedman, the renowned conservative economist whose views were often the opposite of Professor Solow’s.

“Milton was going on about themoney supply,” he recalled in 2009, “so what I said was everything reminds Milton of the money supply. Everything reminds me of sex, but I try to keep it out of my written work.”

He took rhetorical aim at what he deemed vapid criticisms of academic economics by public intellectuals. Always calling on economists to ground their propositions in evidence, he insisted that economics should be “a search for verifiable truths, not a high-school debate.”

About John Kenneth Galbraith, a confidant of President John F. Kennedy and the author of an influential 1967 attack on mainstream economists, “The New Industrial State,” Professor Solow wrote that Mr. Galbraith “mingles with Beautiful People; for all I know, he may actually be a Beautiful Person himself.” But the book, he said, “is for the dinner table not for the desk.”

He called “The Global Crisis of Capitalism,” a book by George Soros, the multibillionaire hedge-fund trader, “embarrassingly banal,” adding that it has “as many escape clauses as it has claims.” The problem, Professor Solow wrote, was that Mr. Soros “wants to be a philosopher, indeed a sort of philosopher-king” and that “in straining, he reveals a fundamental difficulty with the role of philosopher-king. It is too damn hard.”

To Harvard at 16

Robert Merton Solow was born on Aug. 23, 1924, in Brooklyn, to Milton and Hannah (Sarney) Solow. He arrived at Harvard University on a scholarship at age 16, inclined to study botany or biology with an eye toward a secure job in the United States Forest Service. But though he received a top grade in biology, he felt inept.

“I could look in the microscope, but I couldn’t get clear in my head what I was seeing enough to make a drawing of it,” he recalled in 2009. “I’m just not good at that.”

He switched to a free-form major in social sciences, but when he turned 18 at the beginning of his junior year, after the outbreak of World War II, he enlisted in the Army, beginning three years in uniform that “formed my character,” he said. He served in North Africa after the fighting there had stopped, and was deployed to Sicily and the Italian peninsula, where the Army drew on his knowledge of both German and Morse code.

He had studied the language while rooming with a German refugee during his freshman year at Harvard. He learned Morse code as a minimally paid participant in a government-funded program, connected to the Harvard psychology department, to find the best ways to teach it.

“I still, when I walk along the street, if I look at a sign, I’ll say it to myself in Morse code,” he said in 2009. “It’s just a habit I have.”

While waiting to report for military duty in late 1942, he met Barbara Lewis, a Radcliffe student from Trenton, N.J., with whom he corresponded during the war. They married in August 1945, scarcely a week after his troopship had docked in Norfolk, Va.

Her father, he said, must have been dubious about “this guy she had gone out with maybe six times, three years ago.”

Returning to Harvard, he turned almost casually to the discipline in which he would become pre-eminent at the suggestion of his new wife, an economics major who became a noted economic historian. She died in 2014.

In addition to his son John, his survivors include another son, Andrew; a daughter, Katherine Solow; eight grandchildren; and three great-grandchildren.

Professor Solow and his wife lived in Concord, Mass., while they were raising their children, then moved to Boston. About 15 years ago they moved to a retirement community in Lexington. They were longtime summer residents of Martha’s Vineyard.

As a young scholar, Professor Solow served as a research assistant to Wassily Leontief, helping him create the first input-output model of the American economy, for which Professor Leontief was awarded the Nobel in 1973. (An input-output model consists of numbers entered into rows and columns that capture how much of the output of one sector of the economy is used as input to the production of output in each of the other sectors of the economy.) Professor Solow then spent a year at Columbia University before joining M.I.T. as an assistant professor.

“I have never had or wanted any other job,” he wrote at the time of his Nobel, noting the close relationship he developed with another of the profession’s giants.

“I was given the office next to Paul Samuelson’s,” he said. “Thus began what is now almost 40 years of almost daily conversations about economics, politics, our children, cabbages and kings,” he recounted in the publication Les Prix Nobel.

At the Russell Sage Foundation, Professor Solow, long interested in the social effects of economics, supervised a major project studying low-wage work in five advanced economies in Europe and the United States. The study found that such work was far more prevalent in the United States than in the other countries, and that the living conditions of low-wage workers were better in Europe because of a more generous social-safety net there along with rules that provided workers with greater bargaining power.

Although choice posts in Washington beckoned on several occasions — he did serve briefly as a staff member of the president’s Council of Economic Advisers during the Kennedy administration — Professor Solow’s heart was always in academia.

Once, when invited to an embassy party, his secretary was asked his rank so that he could be properly seated according to protocol. “Tell them,” he told her, “I’m a full professor of economics at M.I.T. — and they don’t have anything that high in the government.”

Alex Traub contributed reporting.