The Chips Riding on Nvidia

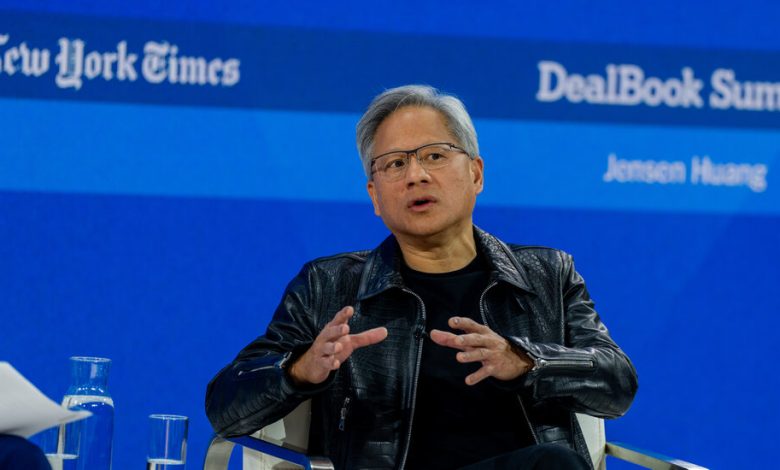

Jensen Huang, the C.E.O. of Nvidia, has overseen huge growth at the chipmaker.Credit…Amir Hamja/The New York Times

Investors brace for “fireworks”

The stock price of the chip giant Nvidia has marched steadily higher over the past year and a half, propelled by investors’ hopes that artificial intelligence is truly transformative technology — and by their hope that the company’s high-end semiconductors will continue to power that technology.

But in recent days, the company became the third most valuable listed company in the U.S., only to slump back to fifth. Its shares will face another big test on Wednesday, when Nvidia announces its latest quarterly earnings, with billions in investor capital on the line.

Brace for a huge move. After seeing the stock more than double since May on the back of huge demand for Nvidia’s chips, investors are wondering if it’s close to peaking. Opinion on Wall Street appears divided: Bloomberg reports that options traders have piled into both put options, whose value rises as a stock’s price falls, and call options. That means that Nvidia’s market capitalization could swing by some $180 billion on Wednesday.

Those bets “suggest that the post-results move is priced to be 10.5 percent in either direction, so stand by for potential fireworks across markets in either direction,” Jim Reid, a strategist at Deutsche Bank, wrote to investors on Wednesday.

That’s after Tuesday’s drop in Nvidia shares wiped out $78 billion in market value. It’s worth remembering that Nvidia has become one of the biggest components of the S&P 500, making it one of the most widely held stocks around. That dip helped pull the index into the red on Tuesday, showing Nvidia’s market-moving power.

What to watch for: Analysts have forecast that Nvidia’s fourth-quarter sales more than tripled year-on-year, and that net earnings for the year grew roughly sevenfold, on the strength of the company’s booming data center business and robust demand for its chips.