Why Oil Prices Have Been Rising Recently

Oil prices have climbed in recent weeks, spurred by concerns over supplies and geopolitical risks, including wars in Ukraine and the Middle East. Analysts say the momentum could carry prices higher.

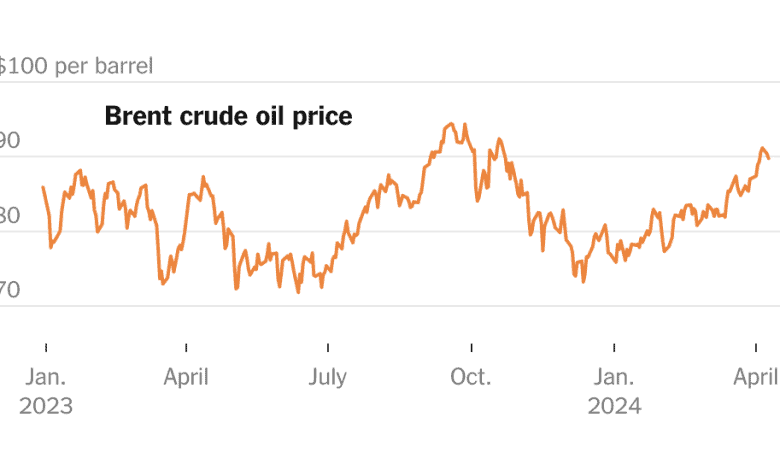

The price of a barrel of Brent crude oil, the international benchmark, has risen more than 20 percent since mid-December. It has jumped more than 10 percent over the past month alone, to around $90 per barrel. “The sentiment is really bullish,” said Viktor Katona, an analyst at Kpler, a commodities research firm.

Rising oil prices could make efforts by central banks to reduce inflation more challenging. In the United States, higher gasoline prices during the summer driving season would also be unwelcome for the Biden administration, which faces a difficult election in November. The average price at the pump has risen about 50 cents per gallon since early January, to around $3.70, according to the Energy Information Administration.

Market watchers note that a short-term retreat in prices, after such a rapid rise, is also possible. The oil price also remains below the peaks reached in 2022, when prices jumped well above $100 a barrel.

In 2023, strong growth in crude output from the United States, the world’s largest oil producer, and other countries outside the Organization of Petroleum Exporting Countries helped reassure markets that there would be enough oil to slake demand. Prices remained subdued for much of the year despite the threats posed by geopolitical tensions. Initially, markets largely shrugged off the risks posed by the conflict between Israel and Hamas.

But 2024 looks like a very different year. Demand has been stronger than some analysts expected. And a series of potentially disruptive events — along with production cuts by Saudi Arabia and its allies — have raised worries of a potential supply squeeze.