What to Watch on Wednesday as the Federal Reserve Meets

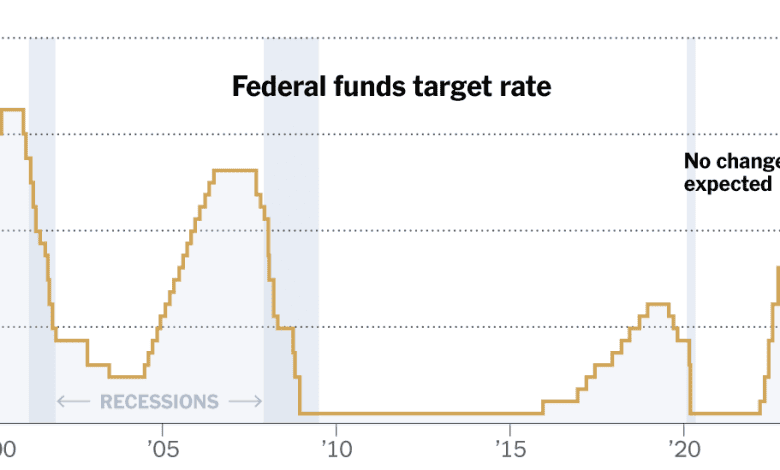

Federal Reserve officials will conclude a two-day policy meeting on Wednesday, releasing a fresh decision on interest rates at a time when economic growth remains resilient and inflation has shown recent signs of stubbornness.

Central bankers are widely expected to leave interest rates unchanged. But investors will closely watch their new economic estimates and what Jerome H. Powell, the Fed chair, says at a news conference for hints at what might come next.

Many economists still expect the Fed to cut interest rates several times before the end of 2024, which could make it cheaper to borrow to buy a house or start a business. But the longer rapid price increases linger, the more likely it is that policymakers will feel the need to keep rates higher for longer in a bid to ensure that inflation is wrestled fully under control.

Here is what to look for in the Fed’s policy statement and its economic projections, which come out at 2 p.m., along with the 2:30 p.m. news conference.

Interest rates are unlikely to change.

Fed officials are widely expected to keep interest rates at their current level, roughly 5.3 percent, where they have been set since July 2023.

While policymakers projected in December that they would likely make three quarter-point rate cuts this year, they have been trying to keep their options open on when those moves might come. Officials want to make sure that inflation is fully under control before they lower borrowing costs, and for now, both key measures of inflation (the Consumer Price Index and the Personal Consumption Expenditures index) are hovering above the Fed’s 2 percent goal.